![]()

When a mortgage approval is not "money in the bank"!

Submitted by Phil McDowell on Thu, 03/25/2010 - 10:09

This is a cautionary about mortgage approvals: there is no "unconditional" requirement for the lender to lend, or the default insurer to insure- if you become damaged goods before the mortgage money has passed through the lawyer's hands.

Unconditional or all conditions met mortgage approvals means the lender, and default insurer if there is one involved, is satisfied with your income, credit, down payment and the property EXACTLY AS IT IS TODAY.

The "unconditional" means the lender and insurer is saying: we will not change if nothing on your a

Easy money may lead to hard lesson

Submitted by Phil McDowell on Wed, 03/24/2010 - 15:13

A Fraud Alert- what are the signs?

Here's the pitch:

- Make $5,000-$10,000 easy and quick!

- Silent partner in a real estate deal

- Property has a government guaranteed insurance for your protection

- You have no administration to do

- Up to you to declare investment earnings because no T-5 issued

- Need to provide Social Insurance, birthday, tell where you work and live

- AND THE REST IS DONE FOR YOU

Here's the problem:

- The money you make is a small piece com

Qualified home inspector looks for grow op evidence

Submitted by Phil McDowell on Tue, 03/23/2010 - 12:50

A reputable buyers' agent realtor will recommend you have a qualified home inspector review the home of which you are making an offer.

The home inspector will look for issues regarding building code violations, the state of repair from the roof to the basement, and for evidence the home was used for a grow op or other drug production.

The inspection may identify the home as a former drug production centre. There are the obvious construction related issues with such a home. Cored basements that may leak, structural damage from creating venting conduits, plus

Beware of early mortgage renewal blend and extend offers

Submitted by Phil McDowell on Mon, 03/22/2010 - 12:47

On the weekend I was asked to analyze a bank "early renewal blend and extend" offer.

The mortgage information, as it was, follows:

Balance= $165,428.87, current rate= 5.1% with 19 months left, $1065.87 monthly payment.

OBJECTIVE: Save money, and be protected from potential higher rates!

What the bank offered:

- No approximate penalty of $6,800 for breaking the existing contract

- 4.99% rate (under the 5.39% posted rate for five year fixed)

- keep the same payment because the objective is to save m

Make an Imperfect home your Perfect Home!

Submitted by Phil McDowell on Sat, 03/20/2010 - 16:52

Many are concerned that their available cash for their initial investment into a home is only enough to cover the down payment, and they have to severely restrict their home choice to near Perfect "as is" homes.

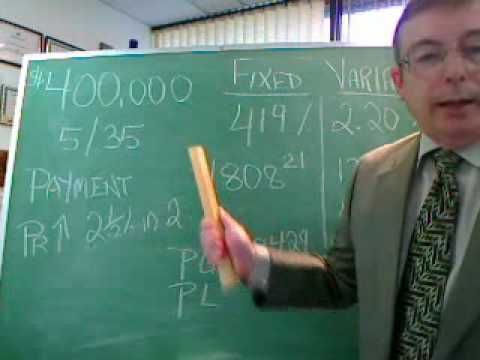

For example, someone with $20,000 down payment who income and credit qualifies for a $400,000 purchase (5% down payment), may avoid homes that are Imperfect "as is" for their needs, because the homes may be missing:

- newly constructed without back yard landscaping, fencing, decking (stairs?), or garage

- older home needing cosmetic upgrades for flooring

Ensure you insure to be assured

Submitted by Phil McDowell on Fri, 03/19/2010 - 13:02

The March 18 Millrise condo fire news coverage showed interviews with folks who were not insured or not adequately insured for fire losses.

Even as a tenant, you would be amazed at the amount of money it would take to bring you back the possessions you lose, even if you could possibly ignore the keep-sakes and memorabillia lost. In the early '80's I was renting a three bedroom home and lost all due to fire. We thought $20,000 was way more than we needed to recover when we bought the insurance coverage. Once we got up to $43,000 in retail replacement, we gave up ite

Do you need a four leaf clover to mortgage qualify?

Submitted by Phil McDowell on Thu, 03/18/2010 - 09:35

MORTGAGE QUALIFYING BASICS- St.

Home Buying fence sitting may be a pain in the wallet

Submitted by Phil McDowell on Tue, 03/16/2010 - 09:56

As a potential home buyer or investor, we all have been riding a picket fence of economic data, forecasts and opinion.

Often the same single article will raise you up and dash you down. It's like sitting on a picket fence.

Take for example a few of the Royal Bank news releases issued in the first half of the month of March.

March 1- Headline: Albertans most upbeat about their personal financial situation (up); but, in same release "29 percent say they or someone in thier household is worried about job loss" (down).

March 8- Albertans most intereste

When PIGS fly there is less pressure to raise mortgage rates

Submitted by Phil McDowell on Sun, 03/14/2010 - 11:07

PIGS is an acronym for Portugal, Ireland (and could include Italy), Greece and Spain. These countries have been in the news because of their relative small population and high precentage of debt to their Gross Domestic Product. There are concerns these countries, especially Greece, may default on their government debt.

A default in any category of investment causes a ripple effect for similar investments. If one country defaults, there is concern and a worry about investing in the sovereign debt of other countries. Canada has a larger popula

Mortgage Insurance- do you have false positive protection?

Submitted by Phil McDowell on Sat, 03/13/2010 - 11:26

Some folks think the mortgage insurance their lender insisted they pay for gives them protection if they can't pay their mortgage payment.

The default insurance loaded to your mortgage balance is to protect the lender only. If you become sick or injured and loss income to pay the mortgage payment, the default insurance cleans up the loss after the house is lost to you.

Moral of the story? Talk to your mortgage professional about getting insurance that will protect you from events that will reduce your income.