![]()

![]()

Share This Page

Critical Illness and Disability Insurance gamble

Submitted by Phil McDowell on Wed, 02/16/2011 - 12:23

CTV News Calgary on February 14, 2011 had a heart-breaking segment about an indvidual thinking they had mortgage payment coverage in case of sickness. She is left with only her job's long term disability pay. Most people will not have enough money to keep their mortgage and property tax payments up-to-date on long term disability pay.

How did that happen? Critical Illness does not cover all sickness and only for very limited disabling causes. So, why did she take Critical Illness, and not Disability....or both coverages? I do not know the details of the interview she had with the representative who signed her up for mortgage protection coverage. But, I will make some educated guesses:

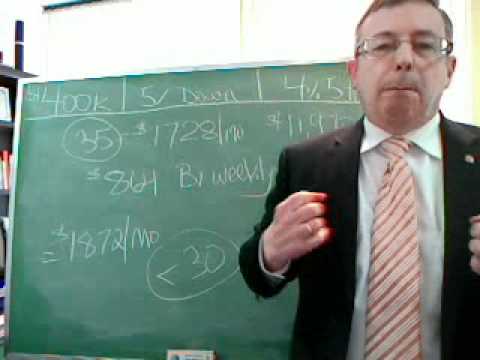

As you get older, insurance premiums go up. Based on an age just under 45, I suspect that both Critical Illness and Disability coverage was equal to about a 12% increase in payments when adding insurance and mortgage payment together.

The Critical Illness coverage is not quite 4 times the monthly premium payment of the Disability Insurance. The Critical Illness coverage will pay the mortgage completely with a successful claim for benefits. Disability will usually only pay up to 12 months of payments; and in the case of the coverage that this person had, the Disability might have covered payments up to 24 months in total. But, to get the additional 12 months, Disability had addtional restrictions. So we compare a paid off mortgage to a year's payment coverage.

On a gamble, the odds seems to favour Critical Illness: 4 times the premium with almost 17 times the pay out.

Critical Illness has some "sex appeal", too. It covers Heart, Stroke and Cancer (not all but most). Everyone has heard of someone having a Heart Attack, Stroke or Cancer. Statistics Canada's mortality tables of 2007 shows about 57% of deaths were because of these three illnesses, so loss of employment would be higher, we can assume.

Critical Illness also covers Blindness, Paralysis, Deafness and Coma. Bonus!

As with all things, the devil is in the details. For this person, the illness was not covered in Critical Illness because the illnesses covered is limited by the policy. She is blind in one eye, but the coverage is only in the event of blindness defined in the policy, not partial blindness.

What is the moral of the story? Take a look at the exclusions of any policy and understand that insurance is a perverse proposition. You are paying out money for something you really hope will not happen to you. The receiving company is taking your money, profiting when they do not have to pay your claim.

Talk to a Certified Financial Planner, especially if they broker insurance coverage. Ask them to give you a letter written in plain language, versus insurancize, that clearly states what could result in no money coming to you or your family for what ever reason.

Note: most mortgage brokers are able to offer creditor life insurance for Life, Disability and Critical Illness, providing a little time to cancel the coverage without cost to you. Take the mortgage broker insurance as a temporary coverage, but have your situation reviewed soon after by a professional in the insurance coverage field.

As a courtesy, do let the mortgage broker know that you are only seeking temporary coverage and you plan to see a professional soon.

Your questions are welcome. info@askphil.ca or call direct Phil McDowell at 403-630-7952.