![]()

![]()

Share This Page

Damned if you don't and damned if you don't

Submitted by Phil McDowell on Fri, 04/23/2010 - 19:53

The Conference Board of Canada March review of home prices for metropolitan areas, produced in March 2010, said house prices in Calgary were most likely to increase between 5-7% in the next six months, year over year.

At the same time, there are a number of forecasts that interest rates are going to increase again.

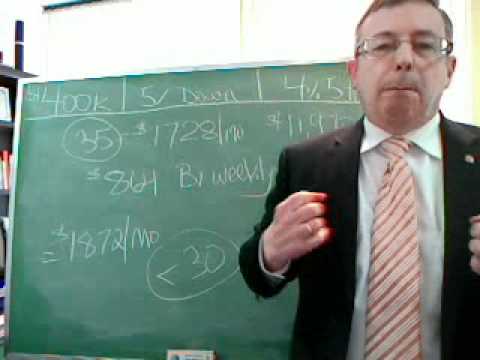

So, what does this mean if you have been struggling to put a down payment together in order to avoid "the boiler-maker mortgage" option? That option is in another video. It has a higher interest rate compared to having a saved down payment, because the down payment is advanced to you when you get your mortgage money.

Look five years down the road to what a "boiler-maker mortgage" balance will be and the interest you will have paid on that mortgage. Compare either a house price increase or an interest rate increase. I have not calculated if prices go up and rates go up because increased employment pushes up the demand curve. This is strictly one happens, but not the other.

If housing prices only increase by 3.25%, at the end of five years your total investment of future mortgage balance, interest paid and down payment made is a little more but basically equal to taking out a "boiler-maker" now.

If the fully discounted interest rates increase by just .65%, in five years your investment of future mortgage balance, interest paid and down payment made is a little more but basically equal to taking out a "boiler-maker" now.

Expectations of home price increases by the Conference Board of Canada anticipate more than a 3.25% increase in price: damned if you don't buy now.

Expectations of interest rate increases by many economists are expected, but there is no concensus as to how high and for how long it will take for rates to increase. But, a .65% change in rates because they have gone up in general or because the lenders are not as generous with their discounts from posted rates, will be less than break even for waiting. Rates may be another damned if you don't buy now.

You may feel prices will go down and rates will go down. And, that is what makes an economy. Consumers make decisions, including not buying.